Builder’s Risk, Course of Construction, and Wrap Policies: Insurance Your Lender Will Demand

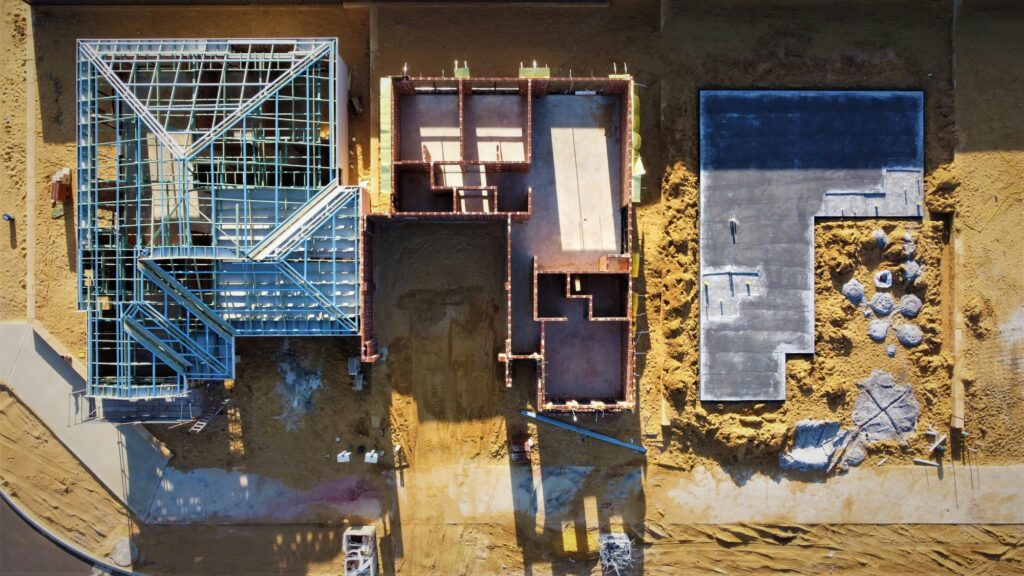

If you’re borrowing to build—whether it’s a custom home, a multifamily development, or a commercial project—your lender isn’t just handing you money and hoping for the best. They’ll demand a very specific insurance package to protect the collateral while it’s being built and to control liability on the site. That’s where builder’s risk (also called course of construction) and wrap-up liability policies come in. This isn’t optional. It’s part of getting your draws, keeping your closing date, and sleeping at night when storms blow in and the copper thieves start shopping your jobsite.

Why lenders are so strict about construction insurance

Financing a project is a risk partnership. You bring the vision, the lender brings the capital, and the insurance protects both of you from surprises that would otherwise sink the deal.

Here’s how lenders think about it:

- Construction is inherently risky. Weather, theft, water damage, fires, workmanship issues, Supply Chain Delays—these hit nearly every project.

- The collateral (your half-built building) isn’t occupiable or income-producing yet. Damage during construction can wipe out the collateral or push the loan far outside its pro forma.

- Losses during construction are expensive to fix and slow to resolve. A moderate water loss can easily add months to a schedule and six figures to soft costs.

So lenders require two pillars of coverage: 1) Property during construction (builder’s risk or course of construction), and 2) Liability protection for site operations (often via a wrap-up policy on larger projects).

They also require control: specific endorsements, notice of cancellation, minimum limits, named storm and flood treatment, the lender listed correctly as loss payee, and more. Getting this right is as much about paperwork as it is about risk transfer.

Builder’s Risk vs. Course of Construction: Same thing, different label

You’ll hear both terms. In most markets, they’re used interchangeably. The policy insures the building while it’s being built or renovated. It’s a special form property policy designed for an unfinished asset with changing values and evolving exposure.

What builder’s risk actually covers

The policy is meant to put the project back on track after a covered physical loss. Typical coverage includes:

- The structure under construction at replacement cost (hard costs: labor and materials)

- Materials on site, in transit, or stored off-site

- Temporary structures (fencing, scaffolding, formwork)

- Site prep and excavation (subject to policy terms)

- Debris removal

- Fire department service charges

- Testing of building systems (if endorsed)

- Some policies include limited coverage for trees, plants, and landscaping during installation

Key optional extensions lenders often want:

- Soft costs: architectural/engineering fees, permits, legal, financing charges, interest on the loan, advertising, property taxes during delay

- Delay in completion (also called delay in start-up or advanced loss of rents): protects income or additional financing costs if a covered loss delays your opening/stabilization

- Flood and earthquake: either required by lender or by location (e.g., in FEMA Special Flood Hazard Areas)

- Ordinance or Law (code upgrade): increased cost to comply with new code after a loss

- Transit and off-site storage increased limits

- Testing coverage (especially for MEP systems and commissioning)

What it usually does not cover:

- Contractor’s tools and equipment (that’s separate Contractors’ Equipment coverage)

- Auto, professional liability, pollution liability

- Wear and tear, latent defects without resulting damage, faulty workmanship (though “resulting damage” from faulty work is often covered while fixing the faulty work itself is not)

- Employee theft (separate crime policy)

- War, nuclear, and other standard exclusions

How much you need to insure for

Lenders typically require completed project value at replacement cost, not just the portion built to date. A simple way to think about it:

- Limit = hard construction costs + overhead/profit on construction + certain soft costs (if required) = completed value.

- Land value is not insured.

The policy should be written on an agreed value or completed value basis to avoid coinsurance penalties. Lenders often demand an “Agreed Value” or “Reporting Form” that waives coinsurance.

Pro tip: If your pro forma changes midstream (value engineering, scope additions), update the limit with your broker. Underinsuring is a painful way to save a few dollars.

Policy term and extensions

- Standard terms: 3–12 months, with extensions available in 3-month blocks.

- Expect an additional premium for extensions (often pro-rated, sometimes with a 25–50% minimum earned premium at inception).

- Set the policy to start before materials arrive and end when the building is accepted, occupied, or replaced by permanent property insurance—whichever occurs first. Many policies automatically terminate at substantial completion or occupancy, so coordinate the handoff to your permanent property policy to avoid gaps.

Renovations and additions need special handling

Renovation projects can be trickier than ground-up because you may need to insure:

- The existing structure, and

- The improvements being made.

Two ways to structure it:

- A renovation builder’s risk policy that includes an “existing structure” limit plus an “improvements” limit; or

- A builder’s risk for improvements and a vacancy endorsement on your existing property policy.

Lenders dislike gaps between “existing” and “new.” Make sure the broker shows exactly how existing structure and improvements are covered and which policy responds first.

Soft costs and delay in completion (the part many people underinsure)

Think about what keeps costing you money when the schedule slips because of a covered loss. Common soft costs:

- Additional architect/engineer fees

- Legal and accounting

- Permit/inspection fees

- Construction loan interest carry

- Advertising and leasing costs

- Real estate taxes and insurance

- Project management and general conditions beyond the original schedule

Delay in completion (also called DSU or ALOP for income properties) addresses:

- Lost rental income or additional interest carry if a covered loss pushes your opening date

- Additional marketing or extended general conditions during the delay

- Often written with a waiting period deductible (e.g., 30–60 days)

How to estimate limits:

- Calculate your monthly burn rate for soft costs and overhead during construction.

- Estimate a realistic worst-case delay from a moderate-to-severe loss (3–6 months for mid-rise projects is common; more for complex builds).

- Limit = monthly burn x months of potential delay.

- For income properties, work with your lender and broker to map projected rent-up schedules and choose either a revenue-based coverage or expense-based coverage. Align the indemnity period with your lease-up timeline.

Lenders love seeing this analysis in writing. It shows you’re planning for the unexpected.

Underwriting information you’ll be asked for

The more complete your submission, the better your pricing and terms. Expect to provide:

- Project description, location, and construction type (frame, joisted masonry, non-combustible, fire-resistive)

- Square footage, number of stories, roof type

- Construction budget and timeline with anticipated start/finish dates

- Distance to coast or brush exposure, flood zone determination

- Security measures: fencing, lighting, cameras, guards

- Water mitigation: daily shutoff protocol, flow-sensors, temp heat vs. permanent, roof dry-in schedule

- Contractor qualifications, license, experience on similar projects, safety program, EMR (Experience Modification Rate)

- Prior losses for owner/GC (5-year history)

- Whether off-site storage or transit is significant

- Testing and commissioning details

- Lender requirements and any special endorsements

What it costs (realistic ranges)

Pricing varies widely by location, construction type, and catastrophe exposure, but here’s a ballpark:

- Builder’s risk premium: typically 1–4% of the total construction cost for a 12-month term. Lower for non-combustible, inland projects with strong controls; higher for wood frame in coastal wind or wildfire zones.

- Soft costs and delay in completion: often add 10–30% to the builder’s risk premium, depending on limits and indemnity period.

- Deductibles: $2,500–$10,000 for general perils is common. Named storm deductibles may be 2–5% of the project limit in coastal areas. Some carriers apply separate water damage deductibles ($10,000–$50,000+) on high-rise or wood-frame projects.

Examples I’ve seen recently:

- $1.2M custom wood-frame home in Central Texas: $4,800 premium for 12 months, $10,000 water damage deductible, $250,000 off-site storage sublimit, no flood.

- $18M mid-rise wood-frame multifamily in the Southeast: $175,000 premium, named storm deductible 3% per building, $2M delay in completion, 12-month indemnity, mandatory water mitigation plan.

- $60M steel-and-concrete office core/shell in the Midwest: $275,000 premium, $1M testing coverage, soft costs included at $5M, DSU not purchased (owner funded).

Practical risk controls that actually save money and reduce claims

Carriers reward good controls. Lenders appreciate seeing them in your risk plan.

- Water management: require daily shutoff of temporary water lines, install flow sensors with auto-shutoff (e.g., on domestic and riser lines), keep drain stacks open, and protect openings before storms. Water is a top cause of large losses on mid-rise and high-rise jobs.

- Theft prevention: secure perimeter fencing, motion lighting, camera monitoring, lockable tool vaults, staggered deliveries of high-value items, and serial number logs for appliances and copper. Theft and vandalism cost the industry hundreds of millions annually; jobsites without lighting or cameras are soft targets.

- Fire prevention: hot work permits and fire watch, no smoking policy, proper temporary heat with clearances, and early installation of standpipes and sprinklers where feasible.

- Wind exposure: temporary bracing, staged sheathing, weather-tight building envelope as early as possible, and a “storm plan” that triggers when wind forecasts exceed set thresholds.

- Documentation: daily photos and logs; they’re priceless in claims.

Common mistakes that cost owners and contractors

- Underinsuring the completed value. A serious loss halfway through the project can exhaust an under-sized limit.

- Forgetting the lender’s loss payable endorsement and notice of cancellation. Certificates alone don’t satisfy lenders.

- Starting work before coverage attaches. Coverage should start when materials arrive—don’t wait for slab pour.

- No soft cost/DSU when financing is tight. If delaying the project three months would break your pro forma, you need it.

- Not insuring the existing structure during renovations. Property policies often limit coverage once a building is vacant or under major construction.

- Assuming the GC’s general liability covers property damage to the work. It usually doesn’t (that’s builder’s risk), and even if it did, litigation will stall your job.

A quick claim story: water loss during rough-in

A developer in the Southeast was framing a 5-story wood-frame apartment building when a plumber left a temporary cap loose. A weekend freeze hit, and when temps warmed, water ran unchecked for hours. Two floors soaked, drywall ruined, flooring warped.

What worked:

- The builder had a 24/7 shutoff protocol and designated a “site captain.” A neighbor called about water, and the captain shut off the main within 30 minutes.

- Daily photo logs made it easy to prove the work completed and materials installed.

- The builder had water damage coverage with a $25,000 deductible and an adjuster onsite within 48 hours.

- DSU was in place; the 45-day waiting period applied, but the delay lasted 62 days, so they recovered a portion of extended general conditions and interest.

Without DSU, the financing carry would have been out-of-pocket. Instead, insurance bridged the gap and the project recovered.

Wrap-up policies: OCIP and CCIP in plain English

On larger projects, lenders often push for a single coordinated liability program called a “wrap-up.” Instead of every contractor and subcontractor using their own liability insurance, the project is insured under one umbrella. There are two flavors:

- OCIP (Owner-Controlled Insurance Program): purchased by the owner or developer.

- CCIP (Contractor-Controlled Insurance Program): purchased by the general contractor or construction manager.

What a wrap typically covers

- Commercial General Liability (CGL) for on-site operations

- Excess/Umbrella liability limits above the CGL

- Sometimes Workers’ Compensation (common on very large wraps or public projects)

- Completed operations coverage for a long “tail” after the project is done (often through the statute of repose)

What it doesn’t cover:

- Professional liability (architect/engineer errors)

- Auto liability

- Contractor’s equipment

- Pollution liability (usually excluded; you can add a separate Contractors Pollution Liability policy)

Why lenders like wraps:

- Predictable limits and uniform terms for all contractors

- Reduced litigation among subs because they’re on the same policy

- Higher umbrella limits to match the project’s risk profile

- Documented completed operations tail—critical for condos and large residential where claims can arise years later

Enrollment and administration

A wrap isn’t just an insurance policy; it’s an administrative program:

- Every contractor and sub must enroll, provide payroll or contract value data, and follow the safety plan.

- Subs remove the cost of GL (and WC if included) from their bids—they receive a “wrap credit.”

- A wrap administrator monitors certificates, OSHA logs, EMR, payroll reports, and site safety compliance.

As an owner/GC, you’ll need:

- A wrap manual spelling out rules and coverage

- An orientation program for all subs

- A process to police noncompliance (no badges = no site access)

Completed operations tail: don’t skimp

For residential and public-facing projects, claims follow you long after ribbon-cutting. The tail should match or exceed the state’s statute of repose for construction defect claims:

- Many states: 6–10 years; some longer or shorter. Coordinate with counsel and your broker.

- Lenders may require a minimum tail (e.g., 10 years on residential condos).

If the wrap tail is too short, you’re back to relying on subs’ policies years later—exactly what wraps are meant to solve.

Cost realities

Wrap pricing varies with project size, type, jurisdiction (e.g., New York “action over” exposure), and limits. Ballparks:

- GL + umbrella wrap (no WC): roughly 1–3% of construction value.

- With WC included: 2–6% depending on payroll classes and experience.

- Higher hazard (wood frame, residential for sale) and high litigation venues push these numbers up.

Don’t forget:

- The wrap credit process: subs should strip their own GL/WC from bids for the project. If you don’t manage credits carefully, you’ll pay for insurance twice.

- Deductibles/self-insured retentions (SIRs): large wraps often use six-figure deductibles per occurrence. Make sure your contracts allocate responsibility for SIRs on sub-caused losses.

Common wrap mistakes

- Partial enrollment: allowing a “favorite” sub to stay on their own insurance. When a claim hits, finger-pointing returns and the lender’s uniform coverage requirement is undermined.

- Inadequate umbrella limits: a $5M tower may be fine for a low-risk renovation, but a high-rise mixed-use may need $25M–$100M. Calibrate to project profile and lender requirements.

- No pollution solution: wraps rarely include pollution. Add Contractors Pollution Liability and consider project-specific coverage if contaminated soils, fuel systems, or spray foam work is involved.

- Short completed ops tail: especially dangerous on condos and multifamily for sale.

A real scenario: wrap saves the day on a high-rise

On a 32-story mixed-use tower, a balcony waterproofing defect led to widespread interior water intrusion during heavy rains—noticed after turnover when units were occupied. Multiple trades were involved: waterproofing sub, concrete sub, and facade contractor. The OCIP had a 10-year completed ops tail and a $50M umbrella.

Benefits:

- One claim program, one adjuster team. No finger-pointing among subs’ insurers for months.

- The project avoided multi-party litigation and funded remediation quickly.

- The lender saw the claim handled within the wrap structure and didn’t escrow loan proceeds for potential litigation costs.

Without the wrap, defense costs alone would have burned months of time and millions of dollars while owners stared at blue tarps.

What lenders will actually ask for (and how to provide it cleanly)

Expect these line items in your loan agreement or draw conditions.

For Builder’s Risk / Course of Construction:

- Policy on special form/replacement cost, written for the full completed value of the project (excluding land)

- Lender named as Mortgagee and Loss Payee with a Lender’s Loss Payable endorsement (ISO CP 12 18 or equivalent)

- Agreed Value or Waiver of Coinsurance

- Coverage effective prior to delivery of materials and maintained until permanent property coverage is in force

- Off-site storage and transit limits adequate for your procurement plan

- Flood and earthquake coverage if in hazard zones (or as lender requires)

- Ordinance or Law (code upgrade) where required by jurisdiction

- Soft costs and delay in completion if financing sensitivity warrants it

- Minimum carrier rating (often A- VII or better by AM Best)

- 30 days’ notice of cancellation/non-renewal (10 days for nonpayment), provided to lender

- Waiver of subrogation in favor of owner, GC, subs, and lender (coordinate with contract waivers, e.g., AIA A201)

- Deductibles within lender-approved thresholds (they sometimes cap named storm deductible percentages)

For Wrap-Up (OCIP/CCIP) on larger projects:

- Evidence of CGL and Excess/Umbrella limits meeting loan agreement minimums

- Completed operations tail matching statute of repose or loan requirements

- Wrap manual and enrollment plan

- Waiver of subrogation, primary and non-contributory wording in favor of owner and lender

- Carrier ratings and policy form summaries

- Workers’ Comp inclusion or confirmation of separate WC compliance, depending on structure

How to deliver this:

- Provide ACORD 28 (Evidence of Commercial Property) for builder’s risk with endorsements attached, not just a certificate.

- Provide ACORD 25 for liability, plus key endorsements: Additional Insured, Waiver of Subrogation, Primary & Noncontributory.

- Attach the Lender’s Loss Payable endorsement and cancellation endorsement wording.

- Summarize in a one-page “Insurance Compliance Memo” mapping each loan requirement to the relevant policy and endorsement. Your draw admin will love you for this.

Step-by-step: getting your insurance bound without delaying your closing

1) 90–120 days before groundbreaking

- Pick a broker with construction depth. Ask about recent builder’s risk placements and wrap programs in your geography and building type.

- Share the lender’s draft insurance requirements and your contract form (AIA, CMAA, or custom).

- Deliver underwriting data: budget, schedule, drawings, security plan, contractor info, and prior losses.

2) 60–75 days out

- Receive initial quotes. Discuss peril-specific deductibles (wind, water, earthquake, theft) and sublimits (off-site storage, testing).

- Decide on soft costs and DSU strategy. Model your monthly burn and a plausible delay duration.

- Identify any lender deviations early (e.g., lender requires flood but you’re X feet above BFE; you may need a flood endorsement anyway).

3) 30–45 days out

- Bind builder’s risk. Make sure effective date aligns with the earliest material delivery.

- Bind wrap (if used) and finalize enrollment plan.

- Collect endorsements and draft the Insurance Compliance Memo.

4) Prior to first draw

- Provide ACORD certificates and endorsements to the lender.

- Confirm loss payee and cancellation notice endorsements are issued correctly.

- Set a calendar reminder 60 days before policy expiration to address extensions if the schedule slips.

5) During construction

- Keep your broker updated on change orders, scope changes, and significant schedule shifts.

- Maintain daily logs and photo documentation.

- Implement your storm and water shutdown plans religiously.

- If a loss occurs, notify the carrier promptly, mitigate further damage, and document everything.

6) Substantial completion

- Transition to permanent property insurance (builder’s risk often ends at occupancy).

- Keep the wrap’s completed ops tail in force as required.

- Archive all insurance and construction records; defect claims can surface years later.

Contract language that plays nicely with your insurance

If you’re using AIA forms (e.g., A201), the insurance section and waiver of subrogation provisions are designed with builder’s risk in mind. The key ideas:

- The owner provides property insurance (builder’s risk) covering the work at replacement cost.

- All parties waive rights against each other for damages to the work covered by property insurance. This reduces litigation and facilitates prompt claims handling.

- Contractors still carry their own CGL, Auto, and WC.

Coordinate with your lawyer and broker to:

- Align the waiver of subrogation in your contracts with the waiver in your builder’s risk policy.

- Ensure the wrap (if used) meets the additional insured and primary/noncontributory requirements in your contracts.

- Address deductibles and SIR cost allocation clearly—who pays if a sub’s negligence triggers the project’s $100,000 wrap deductible?

Owner-builder and custom home projects: what’s different

If you’re building a custom home and acting as your own GC, some carriers will balk. They want professional site management and a track record. You’ll need:

- A licensed GC partner or a construction manager-of-record

- A documented safety plan and site supervision schedule

- Proof of subcontractor insurance (GL, WC) with additional insured and waivers in your favor

- Tighter warranties and indemnity language in your sub agreements

Pricing for owner-builders tends to be higher, and more carriers decline. If you can show experienced oversight and disciplined controls (especially water and theft), you’ll open up better options.

Transit and off-site storage: don’t set yourself up for a limit surprise

Modern projects use just-in-time delivery and off-site fabrication. If your millwork package is stored at a third-party warehouse or your curtain wall panels are shipped from another state, confirm:

- Off-site storage sublimit equals your peak value stored at any one location (many policies default to 10% of project limit or a small sublimit like $100,000–$500,000).

- Transit coverage applies from vendor to site, including loading/unloading, with adequate per-conveyance limits.

- Warehouse agreements are reviewed—some try to limit the warehouse’s liability to pennies on the dollar.

A practical move: Create a simple spreadsheet of major prefabricated or long-lead items with max values in transit and storage at any time. Share it with your broker to set realistic sublimits.

Catastrophe perils: wind, flood, earthquake

Lenders follow mapping, models, and history. You should too.

Wind/named storm:

- In coastal states, expect percentage deductibles and higher pricing for wood-frame projects.

- Install roof dry-in early and track weather windows. Some builders pause sheathing installs if a storm is forecast before permanent bracing is ready.

Flood:

- If your project touches a Special Flood Hazard Area (FEMA Zones A or V), your lender will likely require flood coverage, even if your building pad is elevated. Talk to your broker about primary vs. excess flood options.

Earthquake:

- West Coast and New Madrid regions may require quake coverage. Non-combustible structures with good detailing price better than older retrofit work.

For all CAT perils, model a “what-if” on schedule impacts. That’s how you decide whether DSU limits are adequate.

How builder’s risk and wrap fit with the rest of your insurance program

Think of your project’s insurance as an orchestra:

- Builder’s risk: covers the work in progress (property)

- OCIP/CCIP: covers on-site operations liability and long-term completed ops exposure

- Contractor’s GL/WC/Auto: still needed (especially off-site), and to satisfy contractual requirements not covered by a wrap, or for non-enrolled projects

- Professional liability: architects/engineers carry their own; consider Contractor’s Professional for design-build or delegated design

- Contractors’ Pollution Liability: often project-specific for soils, demo, fuel systems, spray applications, or mold

- Contractors’ Equipment: cranes, lifts, and tools

- Subcontractor Default Insurance (SDI) or performance/payment bonds: protects against sub failure, often a lender requirement on big jobs

A coordinated “insurance matrix” aligning who covers what avoids overlaps and gaps—and makes your lender comfortable signing off on draws.

A lender-ready checklist you can copy

Before loan closing:

- Builder’s risk bound at completed value with lender listed as mortgagee and loss payee

- Agreed Value/coinsurance waiver shown on the policy

- Off-site storage and transit limits confirmed for peak values

- Flood/quake endorsements as required

- Soft costs and DSU limits calculated and bound if needed

- Notice of cancellation endorsement (30/10 days) in favor of lender

- Waiver of subrogation endorsements to match contract terms

- Evidence forms (ACORD 28 and endorsements) delivered

If using a wrap:

- Wrap manual, enrollment plan, and administrator identified

- GL and umbrella limits meet loan minimums

- Completed operations tail aligned with statute of repose

- Pollution solution in place (separate CPL if needed)

- Deductible/SIR handling addressed in contracts

- Evidence forms and endorsements delivered

During construction:

- Update insurance for significant change orders

- Keep documentation of controls and safety meetings

- Maintain water and storm response protocols

Substantial completion:

- Transition to permanent property coverage without a gap

- Confirm wrap tail remains active and funded

- Archive all insurance and construction records

Costs and budgeting: how to avoid surprises

- Timing: lock quotes 30–60 days before start. Markets shift; waiting until the week of closing can be costly.

- Extensions: budget contingency for at least one extension period if your schedule has unknowns. Extensions can add 10–30% of the original premium depending on length and market.

- Deductibles vs. premiums: sometimes increasing a wind deductible by 1% saves real money. Balance lender tolerance with your risk appetite and the project’s liquidity.

- Wrap credits: police them. If subs don’t deduct their own GL/WC costs from bids, you’re double-paying for insurance. Make “wrap credit” a required line item on bid forms.

FAQs I get from owners and builders

Q: If the GC has great insurance, do I still need builder’s risk? A: Yes. The GC’s liability policy responds to claims alleging negligence causing bodily injury or third-party property damage. Your partially built building isn’t a third party. Builder’s risk is the right tool to repair and replace the work after accidental damage.

Q: Is “course of construction” different from builder’s risk? A: Not meaningfully. Carriers use both terms. They’re functionally the same coverage for property during construction.

Q: When does builder’s risk end? A: Typically at occupancy, substantial completion, or when permanent property insurance starts—whichever happens first. Many policies terminate if any part of the building is occupied, so coordinate the handoff carefully.

Q: Can I insure the land value? A: No. Land isn’t insurable against most perils. Insure the improvements and the work in place.

Q: Do I need DSU/soft costs on a small project? A: If a three- to four-month delay would strain cash flow or debt covenants, you’ll be glad you bought it. On small builds funded with cash and flexible timelines, it’s a business decision.

Q: Should I buy an OCIP or let the GC run a CCIP? A: If you want control and can manage the admin, an OCIP gives you transparency. If the GC has strong wrap experience and buying power, a CCIP can be efficient. Either way, align it with your lender’s requirements and enforce enrollment rigorously.

Q: What about renovations where we’re keeping part of the building occupied? A: That’s a specialized exposure. You may need a phased builder’s risk with permission to occupy or separate coverage for the occupied portion. Plan this early; lenders will ask.

A practical buying game plan

- Choose a construction-savvy broker who places multiple projects like yours each year in your region.

- Start early and share complete data. Incomplete submissions drive mediocre terms.

- Have a risk control plan on paper: water, theft, wind, and fire protocols. Carriers price discipline.

- Talk deductibles openly with your lender. Don’t wait for a last-minute surprise that derails closing.

- Decide wrap vs. traditional liability structure by balancing project size, market, and lender needs.

- Document your soft costs/DSU math. Underwriters appreciate rigor; lenders appreciate foresight.

A short case study trio: what coverage looked like, what went right

1) Urban adaptive reuse, $9.5M budget, partial occupancy

- Challenge: Old mill converted to offices, phased occupancy.

- Solution: Renovation builder’s risk included existing structure limit of $3M and improvements $6.5M, permission-to-occupy endorsement, and $1M soft costs. No DSU; owner funded carry.

- Outcome: Water loss during roof tie-in caused $180k damage; claim handled in 30 days. No schedule delay due to aggressive mitigation. Lender satisfied with evidence of coverage from day one.

2) Suburban multifamily, $28M, wood frame, high theft risk

- Challenge: Repeated thefts in the area; lender insisted on DSU.

- Solution: Builder’s risk with $3M DSU, 60-day waiting period; mandatory camera towers and night security during appliance deliveries; off-site storage limit increased to $2M for millwork.

- Outcome: Copper and appliance theft attempt caught on camera; minimal loss. Wind event caused siding damage; the DSU coverage picked up 45 days of extended general conditions after waiting period.

3) Downtown high-rise, $120M, OCIP with 10-year tail

- Challenge: Complex trades, tight site, high litigation venue.

- Solution: OCIP with $5M primary + $45M excess; no WC included; CPL purchased separately for soil vapor mitigation; wrap credits enforced via bid forms.

- Outcome: Post-turnover water intrusion claim resolved under OCIP without multi-insurer disputes. Lender satisfied with tail documentation and did not require additional contingency reserve.

Final thoughts from the field

The best insurance programs don’t just tick lender boxes—they keep your schedule alive when bad days happen. Treat builder’s risk and wrap coverage as part of your project controls, not just line items. Write down your water and storm protocols, set realistic DSU limits if your financing is tight, and make sure the paperwork (endorsements, loss payee, cancellation notices) matches what your loan agreement demands.

When a claim hits, quick mitigation, clean documentation, and the right coverage make all the difference. I’ve seen projects derailed for months over missing endorsements and under-sized limits, and I’ve seen similar projects glide through losses with barely a dent in their timelines because they were dialed in from day one.

Get your broker, your GC, and your lender at the same table early. Share the plan, pressure-test the numbers, and bind coverage ahead of the first delivery truck. It’s the simplest way to protect your budget, your schedule, and your sanity.